The TIP College Programme is a personal accident insurance programme that provides coverage for:

- Natural death (optional)

- Accidental death

- Accidental dismemberment

- Medical dental, optical and transportation expenses arising from accidents.

“Safeguard their future. Make getting an education the only thing they worry about.”

Why TIP College Plan?

- Personal Accident and Death Coverage

- Medical Transportation costs reimbursed

- For all Students at Tertiary Level

General Information

Special Features:

- Five (5) options from which to choose

- Transportation cost reimbursements to and from medical facilities

- Premiums are paid annually at the beginning of each school year

- Protection is immediate, once the school is in receipt of the payment

- The minimum per school is 1

Benefits

- Offers 24-hour 365-day personal accident protection worldwide (weekends and holidays included)

- All students enrolled within the tertiary school

Eligibility

All full time students and full time staff members whose name is on file at an educational institution within Jamaica below the age of sixty (60) years.

Coverage

Coverage is provided to each Insured enrolled on the TIP Student Plan and the TIP College Programme during the academic year, commencing on September of each year. The Insured is covered for 24-hours, 365-days all-risk during school or leisure anywhere in the world. All benefits are payable in Jamaican dollars.

Natural Death (where applicable)

When death occurs by natural causes (other than accidental or suicide), other than by accident or suicide, the Society will pay to the beneficiary the Principal Sum stated in the Schedule of Benefits.

Accidental Death

When injury results in loss of life of the Insured within three hundred and sixty-five (365) days after the date of the accident, the Society will pay the Principal Sum stated in the Schedule of Benefits.

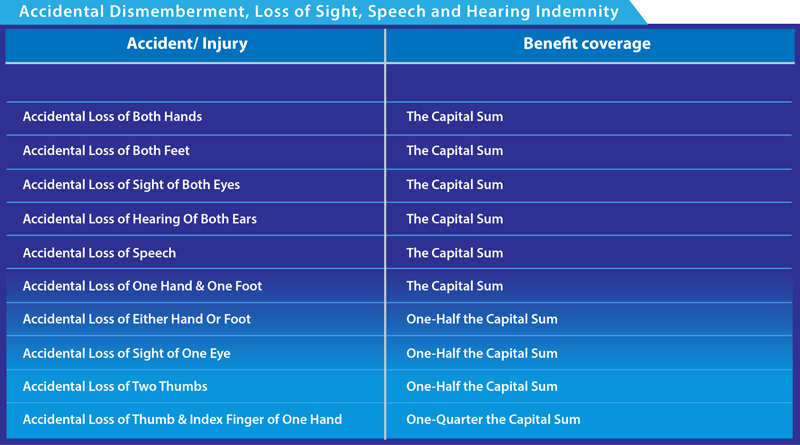

Accidental Dismemberment, Loss of Sight, Speech and Hearing Indemnity

When injury does not result in loss of life of the Insured but does result within three hundred and sixty-five (365) days in any one of the specific losses shown below, the Society will pay no more than one (the largest) of such benefits with respect to injuries resulting from one accident, with respect to any one Insured.

The complete and irrecoverable loss of use of any part of the body specified shall be deemed to be the loss of such part. In the event of partial loss of any part of the body specified above, a proportionately lower percentage of the Principal Sum shall be payable, such percentage to be determined solely by the company.

If you wish to speak to a BDO about your specific needs, please click on the button below to schedule an appointment.